Introduction to Bitcoin History

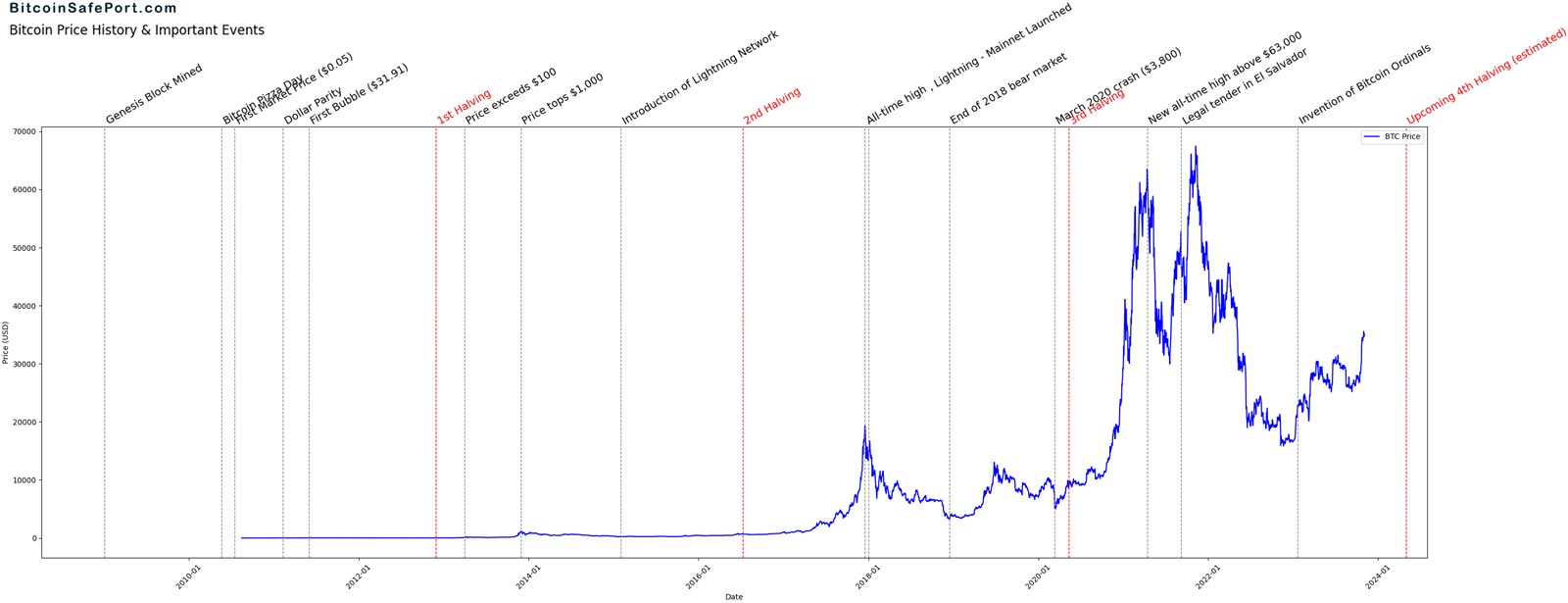

In the annals of financial innovation, few tales are as compelling as the history of Bitcoin. This digital currency, a pioneering force in the cryptocurrency revolution, has been a subject of fascination and study since its anonymous creation in 2009. Bitcoin’s history is a saga of technological breakthroughs, economic turbulence, and a radical reimagining of what currency means in an increasingly digital world.

Birthed by the enigmatic Satoshi Nakamoto, Bitcoin promised an alternative to traditional financial systems: a decentralized, transparent, and secure form of money that operated outside the control of any single institution. Its blockchain foundation has not only powered transactions but also sparked a global discourse on the future of finance.

As we journey through Bitcoin’s history, we will explore the evolution of this cryptocurrency from a concept in a whitepaper to an asset that captures the attention of investors, technologists, and governments alike. Through every high and low, Bitcoin has held a mirror to the changing attitudes towards money, privacy, and the power of decentralized technology.

This narrative aims to provide an exhaustive look at Bitcoin’s history, delving into the key events and milestones that have defined its path. From the mining of the genesis block to the frenzied market cycles that have attracted legions of followers, the story of Bitcoin is as unpredictable as the cryptocurrency market itself.

Now, let’s embark on a chronological exploration of Bitcoin’s storied past, examining the milestones that have carved out its niche in history. Each chapter of this journey will not only recount the factual progressions but also capture the ethos and drive of the community that has built and sustained the Bitcoin ecosystem.

The Birth of Bitcoin: A Financial Revolution

Against the backdrop of the 2008 global financial crisis, a seismic shift was brewing in the world of finance. Traditional trust in banking institutions had faltered, paving the way for a radical rethinking of monetary systems. It was in this climate of uncertainty and skepticism that Bitcoin first emerged, not just as a new currency, but as a revolutionary concept poised to disrupt the financial status quo. The Birth of Bitcoin marked a financial revolution, setting a cornerstone in Bitcoin History.

On October 31st, 2008, a person or group under the pseudonym Satoshi Nakamoto published a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System”. This document laid the groundwork for a decentralized digital currency that didn’t rely on any central authority. Instead, it proposed a system based on cryptographic proof, allowing any two willing parties to transact directly with each other.

The world’s first Bitcoin was mined on January 3rd, 2009, with Nakamoto mining the very first block of Bitcoins, known as the genesis block. Enshrined within this block was a message, a headline from The Times: “Chancellor on brink of second bailout for banks.” This not-so-subtle nod to the prevailing financial turmoil made Bitcoin’s intentions clear: it was to be an alternative to the failing systems, a beacon of autonomy in a sea of institutional control.

In these early days, Bitcoin was more a concept than a currency, with its value being more symbolic than monetary. The first known commercial transaction with Bitcoin didn’t occur until 2010, when programmer Laszlo Hanyecz famously paid 10,000 Bitcoins for two pizzas, an event now celebrated in the crypto community as “Bitcoin Pizza Day”.

Bitcoin’s infancy was met with a mixture of skepticism and curiosity. The network was tested, the code was scrutinized, and the small but growing community of tech enthusiasts, libertarians, and cryptographers began to grasp the full potential of Nakamoto’s invention. They saw beyond the code – they saw a future where financial freedom could be more than just an ideal.

As the network grew, so did the challenges. Bitcoin faced technical hurdles, scalability issues, and the ever-looming threat of regulatory scrutiny. Yet, with each obstacle, the community rallied, driving innovation and building a resilience that would come to define Bitcoin’s history.

The Dawn of Decentralized Money: Bitcoin’s Early Years

From 2009 to 2011, Bitcoin history saw its foundational years, transitioning from an experimental concept to a promising digital currency with a dedicated following. These years were characterized by a pioneering spirit and the exploration of what it meant to have a decentralized currency in a digital age.

The Inception of Monetary Value

In the early days, the value of Bitcoin was more a topic of theoretical debate than practical concern. However, the first known commercial transaction for a tangible good—Laszlo Hanyecz’s pizza purchase—put a price tag on Bitcoins and showcased their potential as a medium of exchange. This event was seminal, as it anchored the idea that this digital entity had real-world value.

Community Formation and Development

Bitcoin’s first years were also about community building. Early adopters began to gather on forums like Bitcointalk, sharing ideas, solving technical challenges, and envisioning the future of Bitcoin. It was a period of intellectual ferment, with discussions ranging from the philosophical implications of Bitcoin to the practicalities of mining and transaction verification.

The Emergence of Bitcoin Exchanges

The birth of Bitcoin exchanges was another milestone in this period. Platforms like Mt. Gox emerged, allowing people to trade Bitcoin for fiat currencies. These exchanges played a crucial role in establishing a market price for Bitcoin and provided a venue for wider participation in the Bitcoin economy.

Real-World Adoption and Recognition

Notably, the early days saw the genesis of Bitcoin’s use in the broader economy. Some enterprising businesses began to accept Bitcoin, signaling a growing recognition of its utility as a currency. These were the early signs of Bitcoin’s potential to become more than just a digital curiosity but a viable alternative to conventional money.

Technical and Security Developments

As Bitcoin began to gain traction, it also faced its first significant challenges. Security incidents, such as the infamous 2010 incident where a vulnerability led to the creation of billions of Bitcoin, tested the network’s resilience. These challenges were met with swift responses from the developer community, leading to protocol improvements and a more robust system.

The Expanding Ecosystem

By the end of 2011, Bitcoin was more than a technical experiment; it had become a symbol of a growing movement towards a new form of money. The ecosystem expanded with the creation of wallets, mining pools, and other services that made Bitcoin more accessible to a wider audience.

The early days of Bitcoin were marked by significant volatility, both in terms of price and network stability. However, these were also the years of extraordinary innovation and the laying down of the foundational ethos that would carry Bitcoin forward. It was in these formative years that Bitcoin proved its resilience and confirmed its potential to disrupt the financial status quo.

Gaining Ground: Bitcoin’s Ascent to Mainstream Attention

As Bitcoin History unfolded between 2012 and 2016, the cryptocurrency moved from internet forums to mainstream media spotlight, gaining attention and credibility. This period saw a burgeoning interest in the potential of Bitcoin not just as a speculative asset but as a transformative technological innovation.

Media Spotlight and Public Curiosity

Bitcoin began to make regular appearances in the media, catching the attention of both the tech-savvy and the financially adventurous. The currency’s dramatic price fluctuations made for sensational headlines, attracting a new wave of speculators and investors to the cryptocurrency market.

Technological Advancements and Mining

Technological advancements played a key role in this era. Bitcoin mining, once the domain of hobbyists, evolved into a more industrial operation with the introduction of specialized hardware, known as ASICs. This professionalization of mining contributed to Bitcoin’s security but also raised questions about centralization and the environmental impact of such activities.

Regulatory Landscape and Legal Recognition

Regulatory developments during these years were mixed, with some countries embracing the technology and others imposing strict controls. The legal recognition of Bitcoin varied widely, from Japan’s move to recognize it as a legal payment method to China’s restrictions on Bitcoin exchanges.

Critical Events and Market Dynamics

Significant events during this time had profound effects on Bitcoin’s market dynamics. The Cyprus banking crisis in 2013, for example, underscored Bitcoin’s potential as a hedge against economic instability. Conversely, the association with illicit activities, such as those on the Silk Road marketplace, presented a public relations challenge and a regulatory flashpoint.

The Maturation of Bitcoin’s Ecosystem

Despite these challenges, the period from 2012 to 2016 was also one of growth and maturation for the Bitcoin ecosystem. The infrastructure improved, with more reliable exchanges, the introduction of Bitcoin ATMs, and the development of more user-friendly wallets. The community also saw the rise of startups and ventures that began to build a more diverse and robust ecosystem around Bitcoin.

The Price Peaks and Valleys

The price of Bitcoin reflected its growing popularity and the attendant speculation. From a mere $5 in early 2012 to over $1,000 in 2013, followed by a crash and a steady recovery, Bitcoin’s price movements captivated the market. Each peak and trough brought Bitcoin into the public consciousness, laying the groundwork for its future surges.

By the end of 2016, Bitcoin had established itself as more than a passing internet fad. It had sparked a global conversation about the future of money and finance, drawing in developers, entrepreneurs, and even traditional financial institutions. As Bitcoin’s network grew stronger and more secure, the stage was set for the next chapter in its history, which would see even greater highs and lows.

The Meteoric Rise: Bitcoin’s Price Surge and Institutional Adoption

The 2017 Bull Run and Beyond

The years following 2016 witnessed a rollercoaster ride for Bitcoin, with the cryptocurrency reaching unprecedented heights. The end of 2017 saw Bitcoin’s value skyrocket to nearly $20,000, capturing the attention of the world. This meteoric rise was fueled by a frenzy of media coverage, a surge in investor interest, and the ICO (Initial Coin Offering) boom that brought cryptocurrencies to the forefront of speculative trading. The subsequent years in Bitcoin history were characterized by unprecedented price surges and growing institutional adoption, cementing Bitcoin’s role in the financial discourse.

Market Corrections and Maturation

The high of 2017 was followed by a significant correction, with Bitcoin’s price plummeting by over 80% from its peak by the end of 2018. This period, often referred to as the “crypto winter,” was a time of consolidation for the market. It weeded out many unsustainable projects and helped to mature the investor base, setting the stage for more stable growth in the following years.

Institutional Interest and Financial Products

One of the most significant developments in recent Bitcoin history has been the growing interest from institutional investors. The introduction of Bitcoin futures on major financial exchanges, the approval of ETFs (Exchange-Traded Funds) in various countries, and the entry of traditional financial firms into the cryptocurrency space have all lent legitimacy to Bitcoin as an investable asset class.

Regulatory Evolution

As Bitcoin’s profile rose, so too did the focus of regulatory bodies around the world. The evolving regulatory landscape has seen a range of responses, from outright bans in some jurisdictions to the development of frameworks designed to integrate cryptocurrency into the financial system in others.

Technological Progress

On the technological front, advancements have continued to enhance Bitcoin’s proposition as a currency. The Lightning Network, for example, has promised to solve some of the scalability issues that have historically plagued Bitcoin, enabling faster and more cost-effective transactions.

Bitcoin in the Global Economy

Bitcoin has also increasingly been seen as a tool for economic empowerment and a hedge against inflation. In times of economic uncertainty, such as during the COVID-19 pandemic, Bitcoin has been compared to “digital gold,” with some investors turning to the cryptocurrency as a store of value.

The Continuing Journey

As of now, Bitcoin continues to write its history with each passing day. It has become a household name, and while its journey is marked by volatility, the underlying narrative is one of growth and increasing acceptance. Bitcoin’s ability to spark debate about the future of money, privacy, and the role of decentralized technology in society is perhaps its most enduring legacy.

Bitcoin’s Milestones: Triumphs and Trials from 2021 Onwards

As we navigate through the more recent past, the period from 2021 onwards stands out with several landmark events that have shaped the current state of Bitcoin.

Unprecedented Price Movements

The year 2021 started with a bang for Bitcoin, as it reached an all-time high of $34,792.47 on January 3rd. This price point was a harbinger of the volatile yet upward-trending year for Bitcoin’s valuation. The crypto giant continued to capture headlines and attract investment, signaling a growing acceptance of digital assets among mainstream investors.

Corporate Embrace and Governmental Endorsements

In a significant nod to Bitcoin’s legitimacy, Tesla announced on February 8th that it had purchased $1.5 billion worth of Bitcoin and would begin accepting it as payment, propelling discussions about corporate treasury investments in digital currencies. Shortly after, on March 13th, Bitcoin’s market capitalization surpassed $1 trillion for the first time, underscoring its growing financial clout.

Regulatory Hurdles and Price Volatility

However, the journey was not without its challenges. On May 19th, China announced a crackdown on cryptocurrency mining and trading, which sent Bitcoin’s price into a tailspin. This move reflected the growing concerns of regulators globally and the impact of governmental policies on the cryptocurrency markets.

A Historic Leap for National Adoption

Amidst the tumult, a historic milestone was achieved on June 9th when El Salvador became the first country to adopt Bitcoin as legal tender. This unprecedented step, officially enacted on September 7th, marked a new chapter for Bitcoin’s use in the mainstream economy.

Technical Progress and User Benefits

On the technical front, August 5th saw the activation of the Bitcoin Improvement Proposal (BIP) 324, a significant update aimed at enhancing user experience by making it easier to recover funds sent to the wrong address.

Resilience and Institutional Adoption

The latter part of the year witnessed Bitcoin’s price resilience, with its value rising above $50,000 on October 7th for the first time since the downturn in May. Furthermore, November 1st marked a pivotal moment for institutional adoption, with the launch of the first Bitcoin exchange-traded fund (ETF) on the New York Stock Exchange, offering investors a new way to partake in Bitcoin’s potential.

Navigating the Waters: Bitcoin and the Global Regulatory Environment

The narrative of Bitcoin is intertwined with its dance with regulators around the globe. As the cryptocurrency gained traction, it inevitably attracted the attention of regulatory bodies, leading to a landscape that has varied from supportive to contentious.

The Early Days of Regulatory Ambiguity

Initially, Bitcoin operated in a regulatory vacuum, a digital frontier largely untouched by government oversight. This lack of regulation was part of its allure, offering a degree of privacy and freedom not available through traditional financial channels. However, this same freedom also made it attractive for less savory uses, which eventually drew the scrutiny of law enforcement and policymakers.

The Onset of Regulatory Attention

As Bitcoin’s popularity surged, so did concerns about its potential for misuse. High-profile cases, such as the takedown of the Silk Road marketplace, underscored the need for regulatory frameworks to address the challenges posed by cryptocurrencies. This period marked a shift from the “Wild West” days to an era where the reality of regulation became increasingly apparent.

Key Developments in Bitcoin Regulation

Regulatory milestones have had significant impacts on Bitcoin’s ecosystem. Notable developments include the IRS’s decision to treat Bitcoin as property for tax purposes, the SEC’s crackdown on fraudulent ICOs, and the Financial Action Task Force (FATF) issuing guidelines for cryptocurrencies.

A Patchwork of Global Responses

Around the world, countries have taken varied approaches to Bitcoin regulation. Some, like Japan, have embraced it with open arms, creating clear tax guidelines and business regulations. Others, like China, have taken a more restrictive stance, banning ICOs and tightening control over cryptocurrency exchanges.

The Implications of Regulation

Regulation has been a double-edged sword for Bitcoin. On one hand, it has provided legitimacy and protection for users, paving the way for institutional investments. On the other hand, it has imposed restrictions that sometimes conflict with the ethos of decentralization and privacy that are central to Bitcoin’s appeal.

The regulatory landscape continues to evolve, with debates around privacy, security, and the role of digital assets in the financial system taking center stage. As Bitcoin becomes increasingly mainstream, its relationship with regulators remains a pivotal aspect of its story, shaping its trajectory in the years to come.

The Evolution of Diversity: Bitcoin Forks and Variants

Bitcoin’s journey is not without its contentious chapters, and among the most significant are the forks that have created new paths in its history. These forks have been pivotal moments, reflecting both the diversity of thought within the Bitcoin community and the adaptability of blockchain technology.

Understanding Forks in Bitcoin

A fork in the context of Bitcoin is a divergence in the blockchain that occurs when there are two or more potential paths forward, often due to disagreements within the community over the best way to scale or enhance the network. Forks can be soft, where the new chain is compatible with the old (suggesting minor upgrades), or hard, where the new chain is incompatible, effectively creating a new currency.

Major Bitcoin Forks

The most prominent Bitcoin fork occurred in August 2017, leading to the creation of Bitcoin Cash (BCH). This hard fork was the result of a long-standing debate over Bitcoin’s scalability. Those in favor of Bitcoin Cash advocated for larger block sizes to allow for more transactions and improved scalability. Another significant fork led to the creation of Bitcoin SV (Satoshi’s Vision), which aimed to adhere more closely to what the creators saw as Nakamoto’s original vision for Bitcoin, particularly in terms of keeping block sizes even larger.

The Community and Market Impact

Forks have often been tumultuous for the Bitcoin community, leading to intense debates and, sometimes, confusion for users and investors. Each fork has the potential to split the community and resources, but they also serve as a testament to the democratic and decentralized nature of Bitcoin’s development process. The market impact of these forks has varied, with some forks leading to significant price volatility for both Bitcoin and the new currencies that emerge.

Other Notable Variants

Beyond the high-profile forks, there have been numerous other variants of Bitcoin that have introduced new features and capabilities. Projects like Bitcoin Gold and Bitcoin Diamond have experimented with different consensus mechanisms and distributions to differentiate themselves from Bitcoin.

The Broader Implications of Forks

The phenomenon of forking has broader implications for the cryptocurrency market as a whole. It highlights the innovative and experimental spirit of the crypto community but also underscores the challenges of governance and consensus in decentralized systems. While forks can be divisive, they also enable the ecosystem to explore new ideas and solutions, contributing to the evolution and resilience of cryptocurrency technology.

Envisioning the Future: Bitcoin’s Prospects and the Ordinals Phenomenon

As Bitcoin continues to mature, its future remains a subject of fascination and speculation. The ecosystem is dynamic, with each development adding a layer of complexity and opportunity. The most recent innovation stirring the community is the advent of Bitcoin Ordinals, a concept that extends Bitcoin’s utility beyond a mere currency.

The Advent of Bitcoin Ordinals

Bitcoin Ordinals have burst onto the scene as a groundbreaking development, bringing the world of non-fungible tokens (NFTs) to the Bitcoin blockchain. In March 2023, the first inscription marked the beginning of a new era for digital collectibles on Bitcoin. With over 33 million inscriptions by September 2023, the growth has been nothing short of extraordinary, showcasing a 126-fold increase within just a few months.

Market Impact and Potential

Initial projections by Galaxy Research and Mining in March 2023 posited that the Ordinals market could reach a staggering $5 billion market capitalization by 2025. This was when the inscription count was a mere 260,000—a number that has since been dwarfed by the actual growth. Their comprehensive reports provide insights into the burgeoning ecosystem, drawing parallels between the rapid adoption of Ordinals and the early days of NFTs on other networks.

Scalability and Infrastructure Evolution

The surge in Ordinals activity has put Bitcoin’s scalability into the spotlight, leading to the longest period of uncleared pending transactions since 2021. This has catalyzed efforts to improve the network’s infrastructure, with enhancements to wallets and marketplaces, and innovations to enable better scalability.

The Future Landscape of Digital Collectibles

Ordinals are not just a testament to the versatility of the Bitcoin blockchain but also a potential game-changer for the digital collectibles market. The creation of image-based inscriptions has already surpassed the initial growth rates of NFTs on competing blockchains like Ethereum, Solana, and Polygon. This indicates a significant shift in the landscape, with Bitcoin potentially reclaiming a portion of the NFT market.

The Broader Implications for Bitcoin

The introduction of Ordinals suggests a future where Bitcoin’s role extends beyond being digital gold. It may become a foundational layer for digital art, collectibles, and various forms of unique digital assets. The growth of Ordinals speaks to the adaptability of Bitcoin and its community to embrace new use cases, potentially leading to increased mainstream adoption and a diversification of Bitcoin’s value proposition.

As we look to the horizon, Bitcoin’s narrative is far from complete. With Ordinals and other innovations, the ecosystem is poised for further evolution, promising to reshape our understanding of digital ownership and the utility of blockchain technology. The future of Bitcoin, as always, is bound to be an intriguing chapter in the annals of digital innovation.

Conclusion: The Ongoing Saga of Bitcoin

Bitcoin’s journey, from an obscure cryptographic experiment to a cornerstone of digital finance, has been nothing short of remarkable. Our exploration through Bitcoin’s history has brought to light the resilience and innovation that underpin this digital asset. From its genesis in the wake of the 2008 financial crisis to the landmark events that have characterized its evolution in the years that followed, Bitcoin has continually adapted and thrived.

The years from 2021 onwards have proven to be a microcosm of Bitcoin’s broader saga, marked by record-breaking highs, mainstream adoption milestones, and significant regulatory challenges. The incorporation of Bitcoin into the legal framework of El Salvador, the embracement by corporations like Tesla, and the rollercoaster of market values illustrate the multifaceted impact of this cryptocurrency.

The advent of Bitcoin Ordinals is the latest testament to the blockchain’s enduring capacity for innovation, opening a new chapter for NFTs and digital uniqueness. This development not only enriches Bitcoin’s story but also expands its potential, signaling new horizons for utility and value within the digital ecosystem.

As we stand at the current crossroads of Bitcoin’s narrative, it is clear that its journey is far from over. With every fluctuation in price, every technological advancement, and every shift in the regulatory tide, Bitcoin continues to forge its path forward. It remains a beacon for decentralization, a challenge to the established financial order, and a continuously unfolding story that invites speculation and study.

The future chapters of Bitcoin will undoubtedly be as eventful and transformative as those that have passed. For observers, participants, and innovators alike, Bitcoin promises a future ripe with possibilities, demanding our attention and participation as it reshapes the landscape of money and technology.